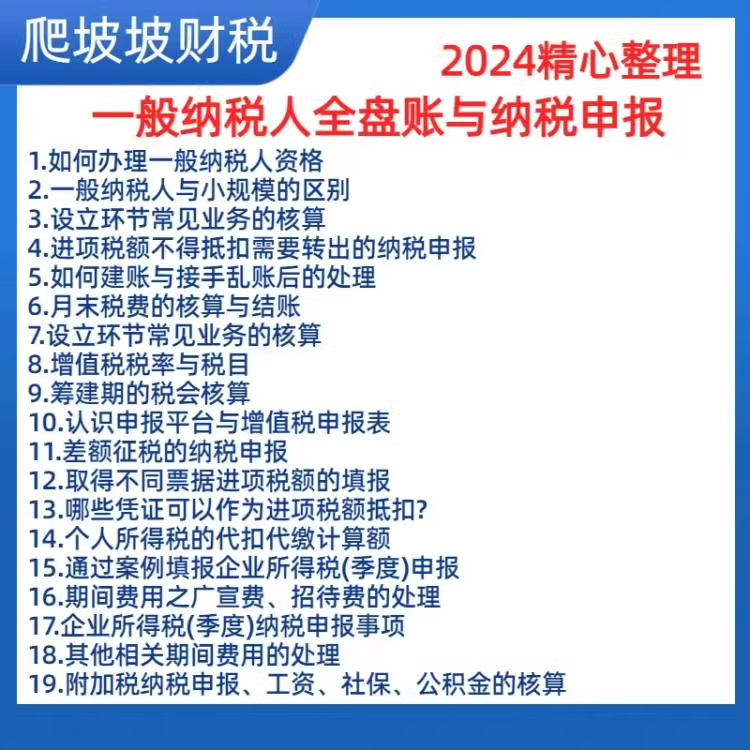

本视频课程详细讲解了一般纳税人从设立到运营全过程中的账务处理与纳税申报。内容覆盖了各类业务的核算与申报,帮助学员从筹建期到运营期,全面掌握税务核算流程。课程涉及差额征税、进项税额抵扣、企业所得税、附加税、个人所得税、增值税等常见税务事项,提供了清晰的申报步骤和实操技巧。同时,课程还详细讲解了期间费用、工资社保、销售与采购等账务处理,帮助您轻松应对税务挑战,确保企业在税务上的合规与稳健发展。

文件大小

- 文件类型:视频

- 文件大小:5.23GB

Disclaimer: All the contents of this site are collected and organized from the Internet, for the sole purpose of learning and communication. If there is no special instructions, are edited and published by thin Baba scarce resources. Without authorization, any individual or organization shall not copy, steal, collect or publish the content of this site to other websites, books or various media platforms. If the content of this site involves infringement or violates your legitimate rights and interests, please contact us to deal with.

Comments (0)